Whether the purchase of real estate will increase in value or decrease in value is a very important question. In particular, many people consider a decline in real estate prices to be a risk and conversely, many people will consider purchasing real estate with the aim of increasing real estate prices.

Therefore, we will consider the factors behind the rise in real estate prices in this time.

Ⅰ. Method of determining real estate assessed value (real estate value)

Real estate prices in Japan are determined by supply and demand. In other words, the market determines the price of a property. However, the market does not determine the value of real estate and only experts (real estate appraisers) can calculate the value of real estate.

Real estate is unique, no two properties are the same.Therefore, real estate prices fluctuate depending on the circumstances of both the buyer and seller. On the other hand, objectivity is required for real estate evaluation and it is required the amount of money by eliminating the buyer and seller circumstances.

Then, in real estate valuation, what part is focused on to determine the real estate price? It is calculated by three methods.

1) Cost method

The cost method is the replacement cost of the subject property at the time of value and then depreciation correct the depreciation about this replacement to obtain the estimated value of the subject property.

2) Transaction case method

The transaction case method

is first, collect a large number of transaction cases and select appropriate cases.Then, it will correct the circumstances and correct point-in-time as necessary for the transaction prices pertaining to these. Furthermore, the prices obtained by comparing regional factors and individual factors are compared and considered in a comparative price and used to obtain an estimated value of the subject property.

3) Income capitalization method

The Income capitalization method is a method of determining the estimated value of a subject property by determining the sum of the present value of the net revenues that the subject property is expected to generate in the future.

These three methods are used to determine the assessed value of real estate.

This real estate valuation is the amount adopted by the government in public announcements of land prices and by courts when financial institutions provide loans, etc. Such amounts indirectly affect real estate prices on the market either.

Ⅱ. Increase in the assessed value of real estate (real estate value)

The following two assumptions can be made.

1) Building prices will always be older after purchase so building prices will decline year by year.

2) Land prices rise and fall depending on rents or redevelopment of the surrounding area.

3) Other

The explanation of 1) is omitted since it is a basic premise. 3) will be explained in the next time as it is lengthy.

About 2) , there are some important things to consider.

There are multiple factors that can cause land prices to rise, but the most common are as follows.

1. Increase in land value due to higher rents in the surrounding area (Income capitalization method and Transaction case method)

2. Redevelopment and other factors will increase prosperity and convenience, and as a result, demand will increase and real estate prices will rise. Naturally, rents in the surrounding area will also rise. (Income capitalization method and Transaction case method)

For example, the number of tourists increases in Hokkaido, Osaka, etc., and rents at nearby stores rise, causing real estate prices to rise. This falls under 1. above.

redevelopment of transportation infrastructure, subway extensions and new stations, new roads and commercial facilities will increase land prices.

This falls under 2 above.

So which of the above two scenarios, 1. or 2. above, is more likely to result in stable real estate price increases?

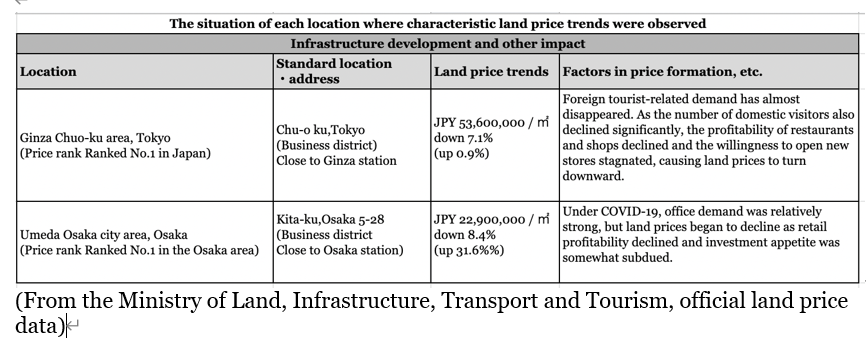

Let’s take a look at the official land price listings for 2021.

First, the official land price report for the year 2021 shows that land prices in Tokyo also declined due to the COVID-19 infection in 2020. The rate of change rose significantly In 2021 either. However, please see below under the assumption that rents still fall in commercial areas and vacancy rates have not recovered as much as they did before the COVID-19.

*Percentages in parentheses indicate the rate of change from the previous year.

The above shows that the highest prices in Tokyo-Osaka have fell. This is mainly due to falling rents under COVID-19.

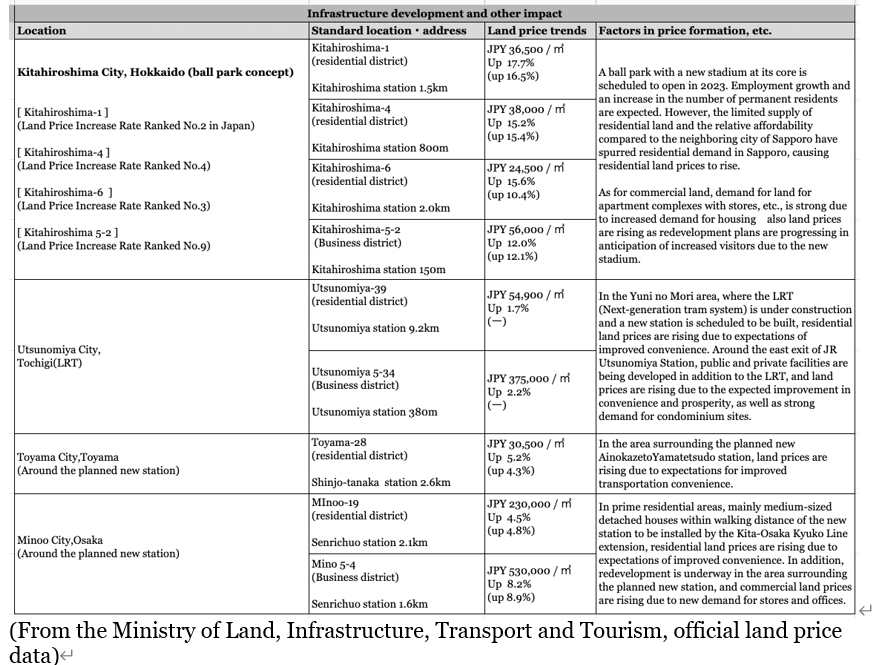

On the other hand, the following shows that land prices have increased even in the same situation under the COVID-19. All of the land price increases are due to infrastructure development, in other words, land prices are rising due to redevelopment.

In the next article, let’s look at how condominium prices have actually changed as a result of redevelopment that has occurred in the past.

【 Summary 】

Real estate prices are not determined solely by the age of the building.

It is determined comprehensively by land price appreciation, transaction examples, and profitability.

Rising land prices are caused by increasing rents, redevelopment, and other factors. Among these, land price increases brought about by redevelopment are the most stable.