People who are not real estate agents, real estate appraisers, urban planners or people in charge of urban planning often said that “Real estate will go down after the Olympics.” What actually happened? Were housing journalists and commentators right?

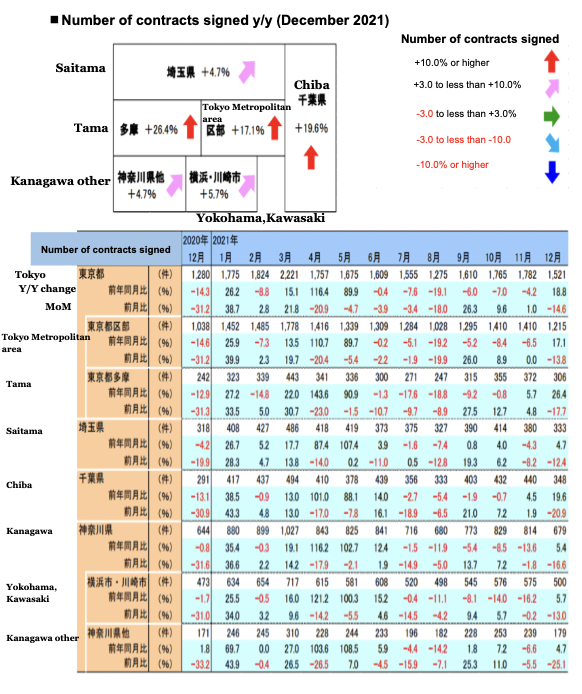

Let’s look at the second-hand condominiums market in 2021.

All regions saw a year-on-year increase in the number of contracts signed

⚪︎Tokyo

In December, the Tokyo Metropolitan area had 1,215 cases and saw a double-digit increase of 17.1% y/y and exceeding the y/y increase in seven months.

In Tama area saw 306 cases, increased 26.4% y/y, exceeding the same month of the previous year following November.

*Tama is a city located in the western portion of Tokyo.

⚪︎Kanagawa Prefecture

In December, the Yokohama-city,Kawasaki-city saw an increase of 5.7% y/y to 500 cases, exceeding the first y/y in 6 months. Other cities had 179 cases, increased 4.7% y/y.

*Kanagawa is located just south of Tokyo.

⚪︎Saitama Prefecture・Chiba Prefecture

In December, Saitama Prefecture had 333 cases,increased 4.7% y/y. Chiba Prefecture saw a double-digit increase of 19.6% y/y to 348 cases and exceeding the same month of the previous year following November.

*Saitama Prefecture is Tokyo’s neighbor to the north.

*Chiba Prefecture is located east of Tokyo.

(From the December 2021 Market Watch by the Real Estate Information Network for East Japan, Inc.)

As you can see, second-hand condominiums have not fallen in the Tokyo metropolitan area.

There has been no collapse in tower condominiums prices, nor has there been a collapse of condominiums management associations due to vacancies, which is said to occur after the Olympics.

This is because real estate prices are not determined by the Olympic event, but are affected by redevelopment such as infrastructure improvement, increased tourism demand from inbound travel, and external factors such as monetary policy.

Why were real estate prices said to fall after the Summer Olympics in the first place?

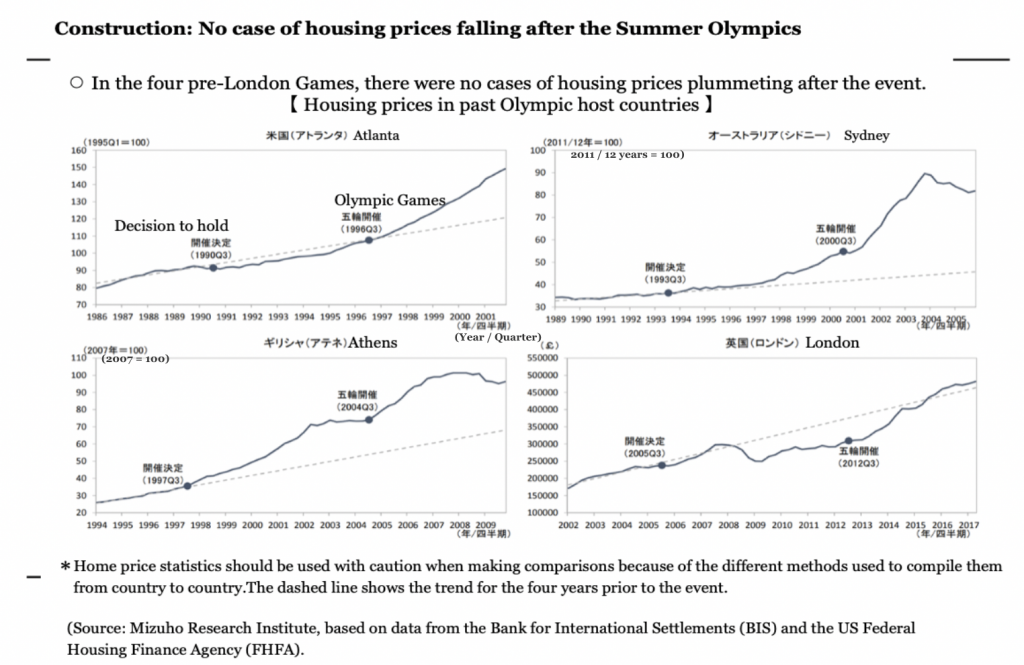

Let’s look at the data where other Olympics are taking place.

Here is data published by Mizuho Research Institute in 2018.

(Mizuho Research Institute 2018 Excerpt from Where is the Tipping Point for Real Estate)

There were no examples of declining real estate prices in the other host cities. So why was it said that only Japanese real estate, Tokyo would decline in value? It was because of the recession that occurred after the previous Tokyo Games. 昭和39From late 1964 to 1965, there was a recession known as the “1965 recession (also known as the “securities recession”).

Japan had been continuing to achieve high economic growth and The boom brought about by the Tokyo Olympics and the construction of the Shinkansen bullet train system led to the growth of stock and government bonds, securities markets and investment money heated up and the government tightened its heated economy.This tightening policy plunged Japan into a recession and real estate prices dropped.

Based on this experience, it was rumored that the economy would go into recession after the Olympics.

It was 59 years ago in 1963.Our lives and economy have changed dramatically. The important thing is not to ask people who seem to know, but to look carefully at the data and examine it.

I read some articles about the Olympics and the decline in real estate prices but there did not seem to be any clear evidence. It is necessary to collect correct information rather than being influenced by opinions.